We recently sat down for a talk with Robin Boustead, an expert in the field of Sustainability and ESG consulting, to discuss the new ESG Compliance regulations being unrolled in Europe. A seasoned professional with over 16 years in the field, Robin introduces himself as an independent sustainability consultant with a versatile portfolio spanning sectors like tourism, ICT, manufacturing, construction, and agriculture. Robin’s expertise finds its focal point in areas such as ESG reporting and carbon management. Presently, his engagements encompass a myriad of impactful projects: from developing a global ESG reporting system to designing an online tool that gauges the carbon footprint of travel enterprises. Beyond these endeavors, Robin’s influence extends to coaching over a hundred companies globally, nurturing their transformation towards resilience and sustainability.

This article serves as a comprehensive guide to the guidance & implementation of Environmental and Social Governance rules that are currently being rolled out as it pertains to businesses in Europe.

Quick Guide to Terms (CSRD, ESG, ESRS)

Confused? See the table which differentiates the three acronyms in descending order of importance and differentiation guide.

AcronymDefinitionDifferentiationESGEnvironmental, Social, and GovernanceA guide for companies to assess, measure and report their environmental, social, and governance activities and impactsCSRDCorporate Sustainability Reporting DirectiveA Directive from the EU to establish a framework for ESG ReportingESRSEuropean Sustainability Reporting StandardsSpecifies the sustainability information that companies must disclose to ensure their ESG reporting is aligned with EU standards

Demystifying ESG Regulations: Unveiling the CSRD, ESRS, and ESG for Beginners

Breaking Down ESG Terminology

In the realm of ESG – the acronym for Environmental, Social, and Governance – there exists a landscape that might seem intricate at first glance. To put it simply, ESG is about how companies consider factors beyond just profits; it involves their impact on the environment and society, and how they’re managed. Now, let’s delve into two key players: the CSRD and ESRS. The CSRD, or Corporate Sustainability Reporting Directive, serves as the starting point. Picture it as a directive from the European Union (EU) to establish a framework for ESG reporting. It’s like a set of rules to encourage companies to disclose their sustainability efforts.

ESRS: The European Sustainability Reporting Standards

The ESRS, or European Sustainability Reporting Standards, emerges from the CSRD. Think of it as a detailed playbook that companies must follow to ensure their ESG reporting is comprehensive and aligned with EU standards (the CSRD). The ESRS emphasizes something called “double materiality.” This is about focusing on the important stuff – both inside and outside a company. Imagine it as a company’s way of saying, “Hey, these are the key ways we do things that affect the world, and this is how we’re making our impacts good news all round.”

Navigating the ESG Regulatory Landscape: A Closer Look at the CSRD and ESRS Impact on Large Companies vs SMEs

In a conversation centered around these regulatory shifts, Robin Boustead shines a light on their relevance, specifically concerning Small and Medium-sized Enterprises (SMEs). The CSRD, endorsed in January 2023, marks a pivotal stride in establishing reporting criteria in line with sustainable practices. This directive laid the foundation for the ESRS, a European sustainability reporting standard that was recently ratified. However, Robin underscores that the path forward is not without uncertainties, as organizations anticipate the imminent requirements, set to be outlined this September, for reporting submission formats and protocols. With the directive’s effective date slated for January 2024, the impending rush to get on top of systems for compliance reporting looms large. Amid this urgency, Robin anticipates a gradual integration of the ESRS into business operations and reporting across Europe, foreseeing an 18-month assimilation period.

Robin highlights that SMEs, while not directly encompassed, could be roped in if they form part of the supply chain linked to larger entities.

As for the scope of application, the directive immediately targets enterprises boasting a workforce of at least 250 employees, an annual turnover of 40 million euros, or assets amounting to 20 million euros. Robin highlights that SMEs, while not directly encompassed, could be roped in if they form part of the supply chain linked to these larger entities. This delineation, he points out, is a significant feature of the directive – extending the reporting obligation up and downstream within the supply chain, culminating in an intricate and comprehensive reporting framework. While larger organizations are currently in the immediate purview, Robin speculates that the European Union’s regulatory landscape will gradually tighten, with thresholds for mandatory reporting potentially diminishing annually, envisioning a future where even companies with just 50 employees will find themselves accountable for extensive ESG reporting by 2028.

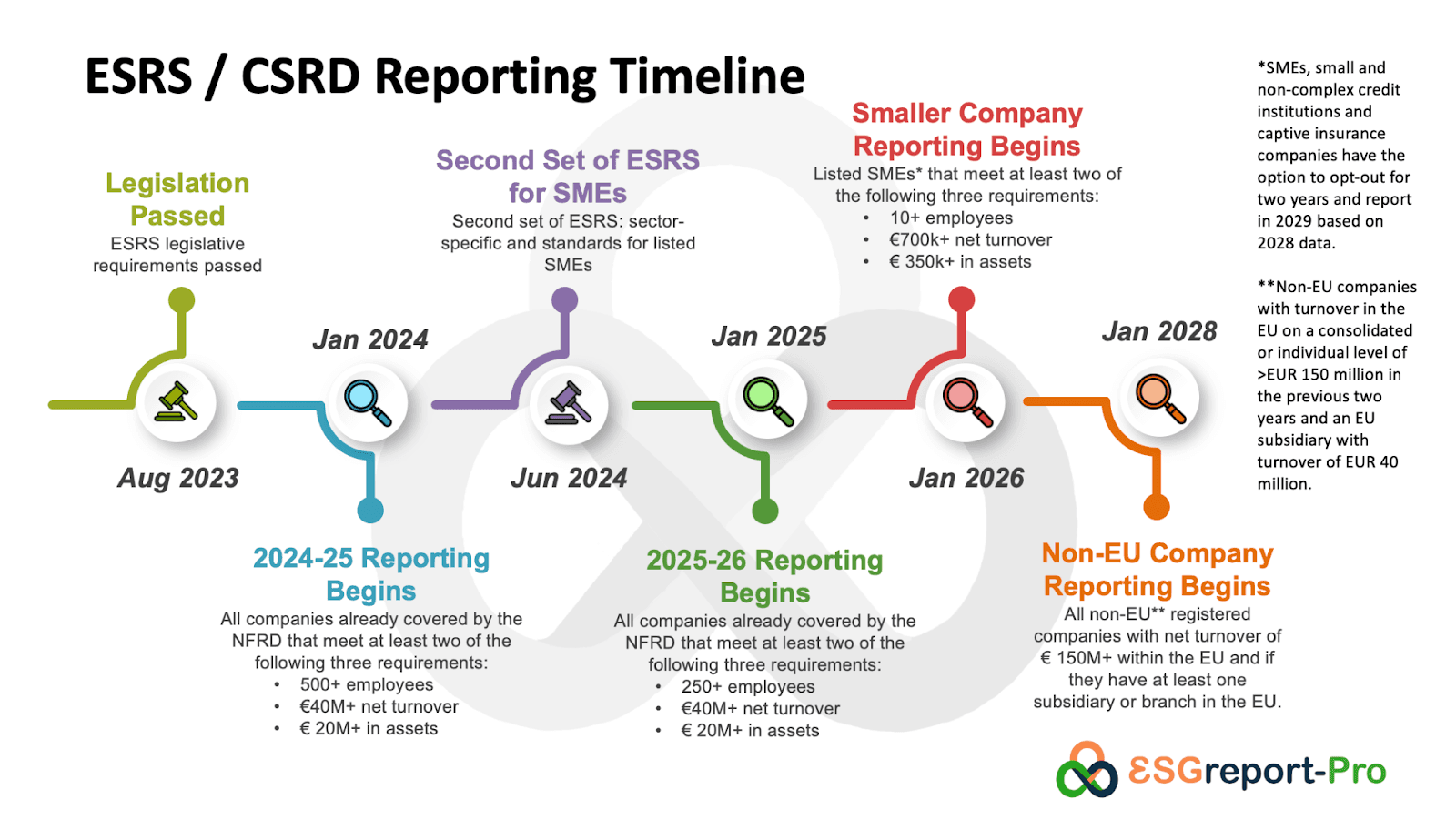

Important Deadlines to Be Aware Of

DateDescriptionRelevant for WhoSeptember 2023Guidelines on requirements for report submissions to be publishedBusinesses of all sizes, starting with large corporates. 1 January 2024Issue of the report in 2025 for the financial year 2024For companies already subject to the Non-Financial Reporting Directive (NFRD) (issue of the report in 2025 for the financial year 2024)1 January 2025Issue of the report in 2026 for the accounting year 2025For large companies that are not currently subject to the Non-Financial Reporting Directive. (issue of the report in 2026 for the accounting year 2025)1 January 2026

Issue of the report in 2027 for the financial year 2026For listed small and medium-sized enterprises (with >10 employees), small and non-complex credit institutions and captive insurance companiesJanuary 1, 2028Issue of the report in 2029 for the financial year 2028Mandatory reporting for companies from non-EU countries. This year it will complete the implementation of regulations for all businesses of all sizes

Charting the Path to 2028: ESG’s Complete Integration into Reporting Frameworks

As the ESG narrative gains momentum, a noteworthy juncture looms on the horizon – the year 2028. This is when Brussels sets the deadline for a new business landscape where all organizations widely embrace ESG reporting systems, a transition that aligns with the broader drive toward sustainable practices. By 2028, the goal is to combine ESG reporting with an ESG rating system, enriching the toolbox available to investors.

RELATED READING: Unlocking Circular Business Models – A Roadmap to Sustainable Transformation

Beyond mere financial performance, this convergence empowers investors to make informed decisions grounded in a holistic understanding of an organization’s impact. Notably, Robin underscores the pivotal role of financial statements, emphasizing that ESG reporting will soon become an integral facet of these disclosures, resonating with the EU’s ambition to embed sustainability at the core of business operations.

Transition Planning: Navigating the Complex Road Ahead

For SMEs embedded within the supply chain of larger enterprises, the journey toward compliance with CSRD and ESRS comes to the forefront. With 2024 as the target year for implementation, strategic preparation becomes paramount. Transition planning, though formidable, is an indispensable endeavor that demands meticulous attention. Robin delves into the intricate process of creating a comprehensive greenhouse gas inventory by scrutinizing all activities relevant to climate impact. Through subsequent risk and opportunity assessments, companies gain clarity on actionable strategies for emissions reduction. The pathway ahead requires an agile mindset that not only optimizes existing approaches but also envisions embracing emergent technologies.

Towards a Comprehensive Reporting Structure

The roadmap for transition involves creating a cohesive strategy that addresses short and long-term emissions goals. Robin’s suggestions to get started include the following steps and things to remember:

Forming a ‘green team’ to undertake this critical task.

Prioritization becomes key, identifying the easiest wins in emissions management.

Subsequent planning maps out the path to 2030, a pivotal year for significant emissions reduction.

Looking further ahead, the target of 2050 urges organizations to strive for minimal to zero negative carbon impact.

Establishing a reporting framework that captures progress over time.

Internal and outward transformation is necessary, involving the intricate network of the entire supply chain.

Activities both upstream and downstream undergo increasing scrutiny

Balancing ESG Implementation and Cost Management: A Pragmatic Approach for Businesses

Navigating ESG Implementation Amid Budgetary Concerns

Where sustainability intersects with business operations, there often arises a concern – how to integrate ESG measures while keeping an eye on the bottom line. Robin Boustead, drawing from his extensive experience, delves into the heart of this matter, acknowledging the apprehensions that businesses, particularly SMEs, might have about the transition. There’s a natural inclination to view ESG reporting as an added weight, a challenge that needs to be managed. Yet, Robin draws a parallel with the introduction of financial disclosure systems in the early 1970s – a transformative move that streamlined business practices and had a profoundly positive impact on the global economic landscape.

Reframing ESG Implementation: An Opportunity in Disguise

Robin sheds light on a transformative perspective: rather than considering ESG as a burden, it should be seen as a catalyst for organizational adaptation and growth. Through the process of ESG reporting, companies often uncover areas they might have overlooked otherwise. This could involve exploring organizational inefficiencies or hidden costs. The journey of creating a greenhouse gas inventory, for instance, frequently leads to revelations about energy consumption that could be optimized, directly influencing the bottom line. Moreover, the ESRS guides companies in nurturing a skilled, capable workforce while aligning with carbon reduction goals. This comprehensive approach, Robin emphasizes, improves business systems, enhancing quality and cutting costs in the medium to long-term.

ESG: A Pathway to Improved Business

Robin attests that the transition towards greater sustainability serves as a conduit for asking more pertinent questions and finding innovative answers. It’s a journey that fosters a mindset of continuous improvement, leading to a stronger and more resilient business model. This was especially true after the COVID pandemic which caught most businesses unprepared and led to significant financial strain and losses for most organisations.

“It’s a journey that fosters a mindset of continuous improvement, leading to a stronger, more resilient, business model.”

The rewards of being agile and efficient are manifold – not only does a greener image attract discerning customers and clients, but it also drives better cost management. Even for micro and small enterprises, this shift promises a more robust business future, where sustainability isn’t just a buzzword but an integral part of thriving in an ever-evolving business landscape.

Strategizing for Swift Success: Navigating ESG Goals

A Roadmap to Achieving 2024 Milestones

As we wrap up our journey through this expert guide to ESG implementation, let’s focus on the steps that will help you meet your 2024 goals. Robin Boustead, drawing on his vast experience, provides practical insights. The first step is to form a ‘green team’ – a group of people from different parts of your company and this team is permanent. Don’t hesitate to include skeptics; their questions can be valuable and they can turn into your greatest advocates.

Addressing Immediate Concerns: A Pragmatic Approach

The journey begins by identifying pressing concerns that are already flagged within the organization. These form the basis for immediate action – the low-hanging fruit that can deliver prompt results. Simultaneously, a robust transition plan emerges as the nucleus of the strategy. This plan charts the trajectory towards carbon neutrality or low carbon operations, a cornerstone that reporting standards universally demand.

Navigating Environmental and Workforce Dimensions

Robin directs attention to two pivotal realms: energy consumption and carbon footprint. These vital metrics offer an entry point to understanding and optimizing environmental impact. Moreover, focusing on workforce indicators galvanizes internal engagement. By empowering employees, businesses cultivate a stronger connection to their sustainability journey.

A Holistic Gaze on Governance and Strategy

The final stage entails a comprehensive appraisal of governance structures and strategic alignment. Robin highlights the significance of aligning policies and goals with the evolving sustainability narrative. With an eye on enhancing organizational strategies and business models, businesses set themselves on a trajectory that resonates with the ethos of ESG reporting.

In this landscape of change, where economic prosperity coalesces with environmental stewardship, businesses find themselves at a pivotal juncture. The path forward is rife with challenges, yet brimming with opportunities to recalibrate operations for a brighter, more sustainable future.

If you have any questions please contact Robin, with the below link:

Connect with Robin on Linked